Parameters Configuration

The Copiix Console provides a comprehensive parameter system that allows precise control over copy trading operations. This unified interface makes it easy to configure and manage operational conditions across all connected terminals with professional-grade precision.

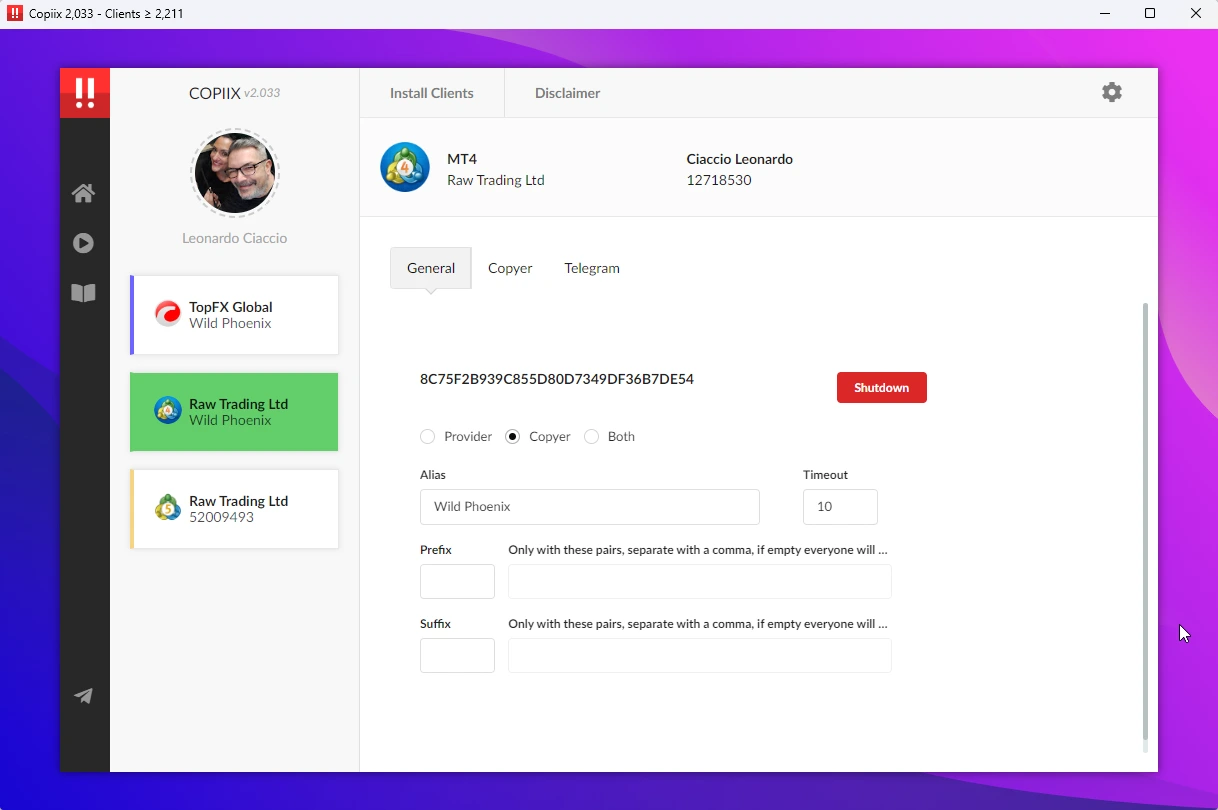

General Configuration

The General section contains fundamental parameters that apply to all operational setups. These core settings establish the foundation for terminal identity and basic operational behavior.

Terminal Identity

ID

Each terminal receives a unique identification code that serves as its reference throughout the system. This ID is automatically generated and cannot be modified, ensuring consistent terminal identification across all operations.

Technical Details:

- Format: Alphanumeric string (MD5)

- Generation: Based on system timestamp and random seed

- Uniqueness: Guaranteed across all instances

Alias

Custom naming system that allows you to assign memorable names to terminals instead of relying on complex IDs. This significantly improves user experience when managing multiple terminals.

Best Practices:

- Use descriptive names (e.g., "Scalping-MT4", "News-cTrader")

- Include strategy or account type

- Keep names concise but meaningful

- Avoid special characters

Terminal Mode Configuration

Provider Mode

Configures the terminal to broadcast trading signals to selected copyer terminals. Provider terminals act as signal sources in the copy trading network.

Provider Capabilities:

- Signal broadcasting to multiple copyers

- Filter management for outgoing signals

- Remote user management (Premium feature)

Copyer Mode

Sets the terminal to receive and execute signals from both local and remote providers. Copyer terminals act as signal receivers in the network.

Copyer Features:

- Multi-source signal reception

- Advanced money management

- Symbol translation and filtering

- Risk management controls

Both Mode

Dual-mode configuration allowing a terminal to simultaneously send and receive signals. Copiix includes built-in protections to prevent signal loops in this mode, ensuring safe operation even in complex setups.

Use Cases:

- Multi-tier trading strategies

- Signal amplification networks

- Advanced portfolio management

- Hierarchical trading systems

Both Mode Precautions

Use Both mode only when necessary. Copiix automatically protects against signal loops, but it is still recommended to carefully test your configuration in a demo environment.

Symbol Management

Prefix and Suffix Handling

Professional brokers often append prefixes or suffixes to standard symbol names (e.g., ecnEURUSD, EURUSDpro). Copiix handles these variations transparently while maintaining standard symbol communication.

Configuration Process:

- Identify Extra Characters: Determine broker-specific additions

- Configure Filtering: Add prefix/suffix in designated fields

- Specify Affected Pairs: Define which symbols require filtering

- Test Translation: Verify correct symbol mapping

Examples:

- ECN Broker:

ecnprefix →ecnEURUSDbecomesEURUSD - Pro Account:

prosuffix →EURUSDprobecomesEURUSD - Micro Lots:

msuffix →EURUSDmbecomesEURUSD

Symbol Filtering

Granular control over which symbols are processed by prefix/suffix rules:

EURUSD,GBPUSD,USDJPY // Only these pairs will be modified

* // All pairs (default)Drawdown and Target Management

If enabled, this feature will automatically close all open trades and, if desired, any pending orders when the global drawdown or profit target is reached.

Connection Management

Disconnect Control

Emergency disconnection feature that safely terminates terminal operations without requiring direct terminal intervention.

Disconnect Process:

- Signal Cessation: Stops sending/receiving new signals

- Order Completion: Allows pending operations to complete

- Safe Shutdown: Cleanly closes all connections

- Status Update: Updates terminal status in the interface

Telegram Notification

Telegram is a widely used messaging application, frequently employed for sending and receiving notification messages for automated systems.

This section allows for the modification and customization of all notifications. Parameters such as tokens and chat IDs are essential for the correct functioning of the system.

This video provides a detailed guide on how to configure these settings:

WARNING

The console must be running and connected to the internet to receive Telegram notifications.

Provider Configuration

Provider configuration manages signal broadcasting, copyer relationships, and distribution controls. This section contains all parameters needed to configure a terminal as a signal source.

Copyer Management

List of Connected Copyers

Displays all terminals configured to receive signals from this provider, including both active connections and previously saved configurations.

Copyer Selection

Multi-selection interface allowing providers to choose which terminals receive signals. The system automatically manages signal distribution to selected copyers.

Remote Provider Services

Signal Distribution Network

Professional feature enabling signal distribution to remote users through Copiix cloud infrastructure.

Remote Provider Benefits:

- Global Reach: Send signals to users worldwide

- Scalable Distribution: Support multiple subscribers

- Revenue Generation: Monetize trading expertise

Remote User Management

Comprehensive system for managing remote signal subscribers:

Subscriber Features:

- User List: View all connected remote copyers

- Access Control: Grant/revoke signal access

Premium Tier Limits:

- Premium Plan: Up to 10 remote users

- Leader Plan: Up to 100 remote users

Provider Filters and Controls

Scheduled Pauses

Time-based signal filtering that automatically pauses signal transmission during specified periods.

Configuration Format:

from/to,from/to,...Examples:

22:00:00/03:00:00 // Overnight pause

14:00:00/17:00:00 // Lunch break pause

22:00:00/03:00:00,14:00:00/17:00:00 // Multiple pausesSignal Type Filters

Control which types of trading operations are broadcast:

- Market Orders: Immediate execution orders

- Pending Orders: Stop and limit orders

Copyer Configuration

Copyer configuration manages signal reception, money management, and risk controls. This comprehensive system ensures signals are executed according to specific requirements and risk parameters.

Signal Management

Copy Controls

SL/TP Copying

Sophisticated control over Stop Loss and Take Profit copying with intelligent error prevention.

Copy Options:

- Always Copy: Replicate all SL/TP levels from provider

- Never Copy: Ignore all SL/TP signals

Symbol Translation

Advanced Symbol Mapping

Professional-grade symbol translation system handling broker-specific naming conventions.

Translation Examples:

DAX:GER30 // Simple one-to-one mapping

UK100:UK 100 // Handle spaces in symbol names

XAUUSD:GOLD // Commodity symbol mapping

SPX500:SP500,NAS100:US100 // Multiple translationsSymbol Exclusion

Precise control over which symbols should not be copied.

Exclusion Patterns:

EURUSD,GBPUSD // Specific symbol exclusionTrade Manipulation

Reverse Trading

Advanced feature allowing inversion of trading signals for contrarian strategies.

Reverse Logic:

- Buy becomes Sell: Long signals become short signals

- Sell becomes Buy: Short signals become long signals

- SL/TP Swap: Stop Loss becomes Take Profit and vice versa

Use Cases:

- Contrarian Strategies: Fade poor-performing signals

- Market Correlation: Exploit negative correlations

- Risk Hedging: Create opposite positions for hedging

- Strategy Testing: Evaluate signal quality through inversion

Configuration:

EURUSD,GBPUSD,USDJPY // Reverse specific pairsComment System

Professional trade identification and management through custom comments.

Comment Features:

- Strategy Identification: Mark trades by strategy

- Performance Tracking: Enable strategy-specific analytics

- Compliance: Meet regulatory documentation requirements

Money Management

Advanced position sizing system offering multiple calculation methods to suit different trading styles and risk management approaches.

Equity to Equity Management

Proportional position sizing based on account equity ratios with sophisticated risk scaling.

Calculation Formula:

Copyer Lot Size = (Provider Lot Size × Copyer Equity ÷ Provider Equity) × MultiplierAdvanced Features:

- Dynamic Scaling: Adjust sizing based on equity changes

- Risk Multiplier: Apply additional scaling factor

Example Scenarios:

Provider: €10,000 equity, 1.0 lot trade

Copyer: €1,000 equity, 0.5 multiplier

Result: 0.05 lot trade (€1,000 ÷ €10,000 × 1.0 × 0.5)Percentage-Based Sizing

Flexible percentage-based position sizing with advanced scaling options.

Percentage Options:

- 50%: Half the provider's position size

- 100%: Exact same position size

- 200%: Double the provider's position size

- Custom: Any percentage value (e.g., 37%, 150%, 275%)

Risk Management:

- Maximum Percentage: Upper limit for position sizing

- Minimum Percentage: Lower limit to ensure execution

- Graduated Scaling: Different percentages for different position sizes

Fixed Lot Sizing

Consistent position sizing regardless of provider's trade size.

Fixed Size Benefits:

- Predictable Risk: Consistent position sizing

- Simple Management: Easy risk calculation

- Account Protection: Prevent oversized positions

- Strategy Testing: Consistent sizing for backtesting

Configuration Options:

- Single Fixed Size: Same size for all trades

- Symbol-Specific: Different fixed sizes per symbol

Money Management Map

The Money Management Map is an advanced feature that allows configuring specific money management rules for different symbols, symbol groups, or Magic Numbers. This provides granular risk control for each asset or trading strategy.

How It Works

The system applies rules with a priority order: if it finds a specific configuration in the map for a symbol, it uses that; otherwise, it applies the default Money Management configuration.

Rule Priority System: 3. Group Match: Macro configurations (e.g., PROVIDER_ID>EURUSD|GBPUSD|USDJPY) 2. Magic Number Match: Strategy-specific configurations (e.g., 123456)

- Exact Symbol Match: Specific symbol configurations (e.g., EURUSD)

- Default Fallback: General Money Management settings

Configuration Formats

🔸 Single Symbols

- Format:

EURUSDorGBPUSD - Use: Specific configuration for a single symbol

- Example:

EURUSDwith Percentage 25%

🔸 Multiple Symbols

- Format:

EURUSD,GBPUSD,USDJPY - Use: Same configuration for multiple symbols

- Example: All major pairs with Equity to Equity 0.5

🔸 Magic Numbers/Labels

- Format:

123456,789012 - Use: Configuration based on robot identifier

- Example: Scalping robots with Fixed Lots 0.01

🔸 Mixed Configurations

- Format:

EURUSD,123456,GBPUSD - Use: Combination of symbols and Magic Numbers

- Example: Specific symbols + specific robot

🔸 Advanced Macros

- Format:

PROVIDER_ID>EURUSD|GBPUSD|123456 - Use: Logical groupings with identifier (always use PROVIDER_ID as the macro name)

- Note:

PROVIDER_IDcorresponds to the unique ID of the provider terminal, as shown in the Console. - Example:

PROVIDER_ID>EURUSD|GBPUSD|USDJPYfor major currencies from a specific provider

Practical Configuration Examples

Example 1: Risk Management by Asset Type

Default Configuration: Equity to Equity 1.0

Map:

1. XAUUSD → Percentage 50% (Metals: reduced risk)

2. BTCUSD → Fixed Lots 0.01 (Crypto: prudent testing)

3. EURUSD → Equity to Equity 1.5 (Majors: more aggressive)Example 2: Management by Different Robots

Provider uses 3 different robots:

- Magic 111111: Scalping

- Magic 222222: Swing Trading

- Magic 333333: News Trading

Map:

1. 111111 → Fixed Lots 0.01 (Safe scalping)

2. 222222 → Equity to Equity 2.0 (Aggressive swing)

3. 333333 → Percentage 25% (Prudent news)Example 3: Advanced Configuration with Macros

Map:

1. PROVIDER_ID > USDJPY | USDCHF | USDCAD → Percentage 30%

2. PROVIDER_ID > GBPJPY | EURJPY | GBPAUD → Equity to Equity 2.0

3. PROVIDER_ID > XAUUSD | XAGUSD → Fixed Lots 0.05

4. PROVIDER_ID > 111111 | 222222 → Fixed Lots 0.01Step-by-Step Configuration

Step 1: Choose Money Management Type

- Select from Equity to Equity, Percentage, or Fixed Lots

- Enter appropriate value

Step 2: Define Symbols/Criteria

- Enter symbols separated by commas:

EURUSD,GBPUSD - Or Magic Numbers:

123456,789012 - Or combinations:

EURUSD,123456,GBPUSD

Step 3: Add to Map

- Click "Add Symbols/Labels"

- Configuration appears in the list

Step 4: Test Configuration

- Verify rules work as expected

- Use demo account for testing

Best Practices

- Start Simple: Begin with basic symbol-based rules

- Test Thoroughly: Use demo accounts to verify configurations

- Monitor Performance: Regularly review rule effectiveness

- Document Rules: Keep clear records of configuration logic

- Regular Updates: Adjust rules based on performance data

Important Considerations

- Rules are processed in order of specificity (exact match → partial match → default)

- Overlapping rules may cause unexpected behavior

- Always test new configurations on demo accounts first

- Consider market conditions when setting aggressive multipliers